Renato Rodic

Mortgage Loan Originator

NMLS# 1615600

GET A GREAT MORTGAGE RATE

Use one of our quick & easy tools to find out what you qualify for, FREE!

Renato Rodic

Mortgage Loan Officer

NMLS#1615600

GET A GREAT MORTGAGE RATE

Use one of our quick & easy tools to find out what you qualify for, FREE!

LOAN OPTIONS SERVICES

Finding You The Best Mortgage Option

FHA LOAN

An FHA loan is a mortgage loan that is insured by the Federal Housing Administration (FHA). Essentially, the federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments.

CONVENTIONAL LOAN

Conventional loans are any mortgage that is not guaranteed or insured by the federal government. Although a conventional loan is not insured or guaranteed by the government, it still follows the guidelines of government sponsored enterprises,

USDA LOAN

The United States Department of Agriculture (USDA) gives borrowers the opportunity to own a home outside of the city limits. There are several benefits of a USDA loan,including flexible credit underwriting requirements and no down payment required.

JUMBO LOAN

A jumbo loan is a loan that exceeds the conforming loan limits as set by Fannie Mae and Freddie Mac. As of 2020, the limit is $510,400 for most of the US, apart from Alaska, Hawaii, Guam, and the U.S. Virgin Islands, where the limit is $765,600.

15-YEAR FIXED MORTGAGE

Need financing options on a home, or other real estates? Choosing a purchase loan product that matches your goals and making sure you get a favorable rate doesn’t have to be stressful! We’re here to make the home loan process easier,

VA LOAN

A VA loan is a mortgage loan in the United States guaranteed by the U.S. Department of Veterans Affairs (VA). The loan may be issued by qualified lenders. The VA loan was designed to offer long-term financing to eligible American veterans .

30-YEAR FIXED MORTGAGE

The traditional 30-year fixed-rate mortgage has a constant interest rate and monthly payments that never change. A 30-year fixed-rate loan may be a good option if you plan on staying in your home for years to come.

FREE TOOLS

GET YOUR FREE PRE-QUALIFICATION LETTER

GET YOUR FREE REFINANCE ANALYSIS

GET YOUR FREE SEARCH HOMES FOR SALE

GET YOUR FREE HOME INSURANCE QUOTE

WHAT WE DO

Secure a home purchase loan that utilizes today’s great mortgage rates to make your dream home affordable.

Seize opportunity as soon as you can with our fast funding options, giving you the freedom to cure that house fever.

Take advantage of your home’s equity with a cash-out refinance. It’s your cash — spend it how you see fit.

Lock in great terms with current interest rates to ensure your home remains affordable—or build more equity with an update!

Know where you stand. With a property evaluation in hand, you’ll have better access to your options so you can see the next move.

Don’t just take the first offer. Shop around. Use our rate comparisons to find the best possible plan for your home ownership strategy.

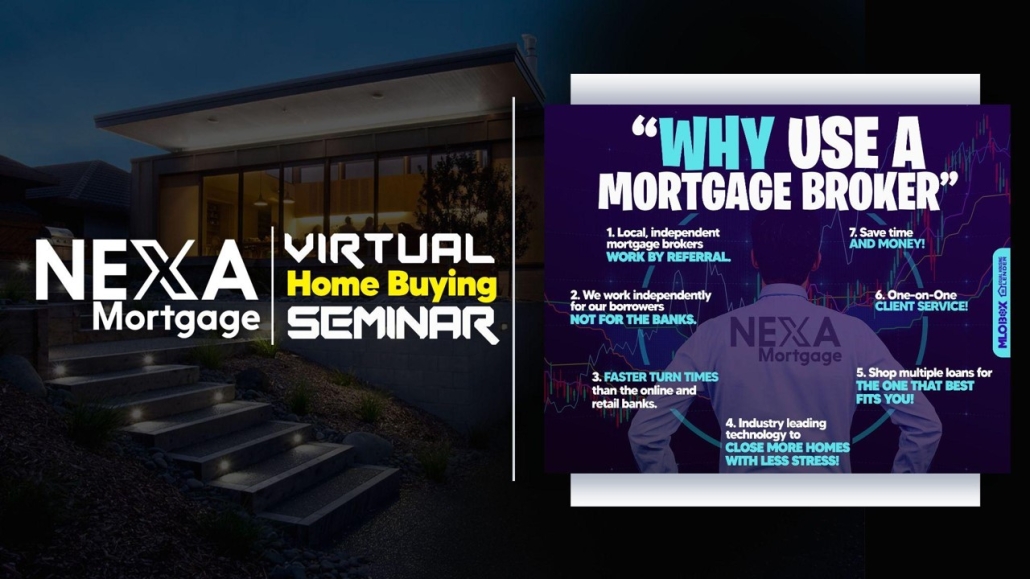

VIRTUAL HOME BUYING SEMINAR

Whether you’re just starting out or ready to close, our home-buying workshop offers everything you need to know as you prepare to buy a home:

- Understand your costs upfront

- Determine a price range that’s comfortable for you

- Find out how a real estate agent can help you

- Learn how your credit score can impact your loan

- Organize paperwork for a smoother loan process